Why Expense Tracking is Crucial for Small Businesses

In the dynamic realm of small business, prudent financial management is paramount. Every dollar holds significance, making meticulous expense tracking indispensable. The ability to maintain a firm grasp on financial inflows and outflows empowers informed decision-making and maximizes expenditure efficiency. Imagine the impact of having complete visibility into your finances, enabling proactive measures that propel business growth. This post delves into the pivotal role of tracking every expense, offering actionable insights to enhance financial oversight effectively.

Effective Expense Tracking Techniques for Small Business Owners

Effective expense tracking is crucial for small business owners looking to maintain financial health and foster business growth. Leveraging robust accounting software such as QuickBooks or FreshBooks automates transaction recording and categorization, significantly saving time and minimizing errors. Furthermore, adopting digital receipt management practices with tools like Expensify or Receipt Bank ensures meticulous documentation and easy access to expense records. Categorizing expenditures into categories such as office supplies, travel, and utilities provides clarity on spending patterns, empowering informed financial decision-making. Regular monthly expense reviews facilitate timely adjustments and adherence to budgetary goals. Establishing a dedicated business bank account separates personal and business finances, simplifying financial management and ensuring accurate bookkeeping. Monitoring recurring expenses, such as subscriptions, and generating detailed expense reports uncover cost-saving opportunities and enhance cash flow management. These proactive measures not only offer a clearer financial overview but also bolster fraud detection capabilities, securing business finances effectively.

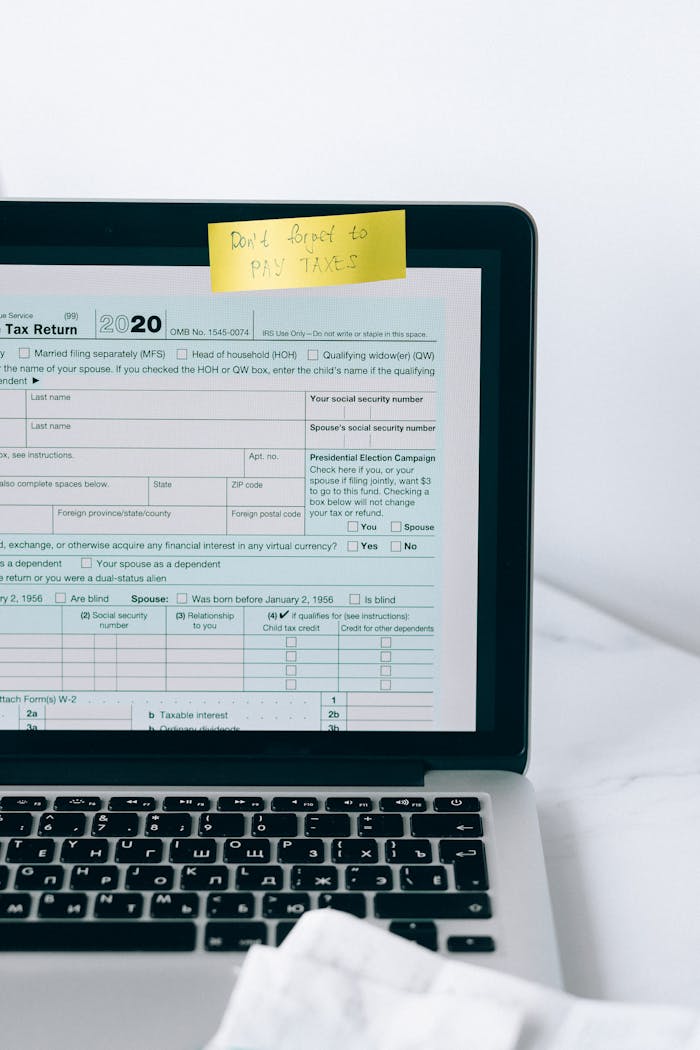

Achieve Financial Success with Comprehensive Expense Tracking

Achieving financial success for your small business hinges on effective expense tracking strategies. By meticulously monitoring every expense, business owners gain critical insights into their financial health, enabling informed decision-making and strategic planning. Comprehensive expense tracking not only facilitates accurate budgeting but also identifies opportunities for cost reduction, optimizing resource allocation for business growth. It streamlines tax preparation by ensuring all deductible expenses are properly documented, minimizing tax liabilities and compliance risks. Furthermore, proactive cash flow management, supported by regular expense reviews, safeguards against financial instability and enables timely decision-making. Detecting and addressing irregularities promptly enhances financial security and operational efficiency. Embrace comprehensive expense tracking as a cornerstone of your business strategy to drive sustainable growth and profitability.